This is an interesting report on Zillow Real Estate Research with the conclusion that the looming Student Debt crisis is not impacting the housing market. But we are not convinced because the mere presence of student loan on your credit history, qualifies the buyers for less mortgage. No lender will ignore such a large payment.

Read and decide for yourself.

*******************************************

SEATTLE, Sept. 17, 2015 /PRNewswire/ — Having a lot of student debt doesn’t greatly reduce young people’s chances of homeownership, as long as they graduate, a new analysis by Zillow has found.i

The findings challenge a popular concern: that giant student loan payments are holding back people from homeownership. As it turns out, graduates’ debt loads don’t materially hurt their chances of homeownership – especially if they get at least a four-year degree.

“College students paying their tuition with borrowed money can rest easy this fall in their dorm rooms: the income advantage of getting a degree pays off in terms of being able to buy a home in the long run,” said Zillow Chief Economist Dr. Svenja Gudell. “Student debt isn’t the evil-doer it’s made out to be, at least not when it comes to homeownership. As long as students stay in school and get a degree, student debt doesn’t deter them from homeownership, although it is possible that student debt could delay homeownership. People in their 20s and 30s are renting longer because they’re delaying marriage, paying a lot in rent, and struggling to qualify for a mortgage when they finally find an affordable home. Add to that list that they are paying off student debt.”

Here are some key findings:

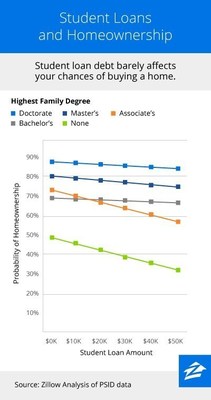

- Student debt has only a small negative effect on the odds of homeownership for a person with a bachelor’s degree or higher. The chances of a married coupleii with no student debt owning a home are about 69.8 percent if at least one of them has a bachelor’s degree. If the same couple has $30,000 in student debt, their homeownership chances drop slightly, to 67.7 percent.

- The least likely to own homes are people who have student debt, but no degree. In fact, a couple who borrowed more than $30,000 for school but never graduated has a less than 40 percent chance of homeownership.

- Graduates with advanced degrees are the most likely to own a home, even if they racked up a lot of student debt. For example, if a couple owes $50,000 in student loans, but one of them has a master’s degree, they have a 75 percent chance of homeownership. A similar household with just $10,000 in loans and only a bachelor’s degree has just a 69 percent chance of homeownership.

- Student debt has the greatest impact on the homeownership rate of people with two-year associate’s degrees. A couple with AA degrees and no debt has a 70 percent chance of owning their home. That declines significantly as debt grows. If the same couple has $50,000 in student debt, they own their home only 57 percent of the time.

- Getting an associate’s degree improves chances of homeownership until a person has borrowed $70,000. After that, their chances of homeownership would have been better without a degree and no student loan debt.

- Getting a bachelor’s, master’s or doctorate degree – regardless of debt – increases the chances that people will buy a home.

Zillow

Zillow® is the leading real estate and rental marketplace dedicated to empowering consumers with data, inspiration and knowledge around the place they call home, and connecting them with the best local professionals who can help. In addition, Zillow operates an industry-leading economics and analytics bureau led by Zillow’s Chief Economist Dr. Svenja Gudell. Dr. Gudell and her team of economists and data analysts produce extensive housing data and research covering more than 450 markets at Zillow Real Estate Research. Zillow also sponsors the quarterly Zillow Home Price Expectations Survey, which asks more than 100 leading economists, real estate experts and investment and market strategists to predict the path of the Zillow Home Value Index over the next five years. Zillow also sponsors the bi-annual Zillow Housing Confidence Index (ZHCI) which measures consumer confidence in local housing markets, both currently and over time. Launched in 2006, Zillow is owned and operated by Zillow Group (NASDAQ:Z and ZG), and headquartered in Seattle.

Zillow is a registered trademark of Zillow, Inc.

i This analysis uses data from the 2013 Panel Study of Income Dynamics.

ii The probabilities come from a model that predicts homeownership on several socioeconomic factors including highest degree earned and student debt outstanding. For the probabilities quoted here we used a married couple in their early 30s with children, and set income and wealth to be the average of a household with similar education levels.

Photo – http://photos.prnewswire.com/prnh/20150916/267464-INFO

SOURCE Zillow